Strategic Investment Framework for Apple iFamily of Internet Products

In this section we apply the Cyclefund Strategic Investment Framework to Apple's complete family of Internet connected products, including Apple Internet connected hardware products, Internet connected software products, and Internet connected service products. We refer to Apple's family of Internet connected hardware, software, and service products conceptually as the iFamily solution suite.

We have selected Apple and its prospective iFamily offering for the very first application of the strategic investment framework because we firmly believe that the next wave in consumer technology will not be driven by mass adoption of individual consumer products, as has been the case with the current mobile wave in smartphones and tablets, but mass adoption of suites of consumer products. As we shall see, Apple and three other global-scale firms are well positioned to potentially dominate this next massive wave in consumer computing technology. The transition from product-based adoption and competition to suite-based adoption and competition is not unprecedented, as we illustrate below.

The Dominant Software Suite for the Graphical PC Era

In the late eighties and early nineteen nineties, product-based competition was fierce in the personal computer software industry as business and consumers rapidly adopted individual software applications to meet their computing needs. At that time, if PC users need to perform financial calculations or create financial models, they would buy a spreadsheet application program, such as Lotus 1-2-3, Borland Quattro Pro, or Microsoft Excel. Similarly, if a PC user needed to write a memo, letter, or document, they would by a word processing application program, such as WordPerfect, Lotus Ami Pro, or Microsoft Word. And lastly, if they needed to give a presentation, they would buy a presentation package, such Lotus Freelance Graphics or Microsoft PowerPoint.

In the early nineties, Microsoft changed the game forever in the PC application software market, shifting it from the traditional approach based on product-oriented model to a new approach based on suite-oriented model, with the mass adoption of Microsoft Office for Windows, which included Microsoft Excel, Microsoft Word, and Microsoft PowerPoint as core components of the suite. The benefits to business and consumer users were crystal clear: pay one relatively low price and get everything needed in one box, with the added benefit that it all works together seamlessly under a familiar user interface. The benefits to Microsoft were also crystal clear: sell one integrated application software package that competitors cannot match and capture every business and consumer PC user on the planet, with the added benefit that it also accelerates sales of the underlying Microsoft Windows operating system platform.

How did this suite vs. non-suite competition end? Poorly for Lotus, Borland, and WordPerfect. While these three companies each had very strong application software offerings in their respective individual product classes, none of the three could produce an integrated application software suite to rival Microsoft Office. The lack of competition in the suite-oriented application software market, as well as its synergistic effect on sales of Microsoft Windows, enabled Microsoft to dominate the PC application software market and the PC system software market throughout the graphical PC era, minting numerous Microsoft millionaires and handsomely rewarding shareholders throughout the nineties.

The Dominant Solution Suite for the Post-PC Era

With this background in mind, we can now posit the following critical question for the post-PC era: Is the transition that we experienced from a product-oriented model to suite-oriented model in the graphical PC era happening right at this very moment in today's post-PC era? Specifically, what if users in the post-PC era were to begin adopting consumer technology not on a device-by-device basis, but rather on a suite-by-suite basis? Would that not change everything for leading firms in our post-PC world today, just as it did for the once-invincible Microsoft during the graphical PC era of yesterday? We strongly believe that it would, and as we shall see only a very small handful of companies possess the strategic assets required to capitalize on this new suite-oriented model for the post-PC era.

Unlike the killer software suite for the graphical PC era, the killer solution suite for the post-PC era is not limited to software, and that is precisely why we use the term solution suite. Certainly as was case for the graphical PC era, the killer solution for the post-PC era includes both application software and system software, but it goes well beyond just software to include hardware devices, cloud services, and retail services, as we shall illustrate below with our formal definition herein of the killer solution suite for the post-PC era, as represented by a new concept we call the iFamily post-PC suite of solutions.

Apple iFamily of Internet Hardware, Software, and Services

The iFamily solution suite concept is extraordinarily vast in its comprehensive scope and architectural structure and wholly unprecedented in the consumer technology industry. When this new concept is applied specifically to Apple, we refer to it as the Apple iFamily post-PC suite of solutions. Apple iFamily comprises the following strategic categories of Internet connected hardware devices, system software, application software, cloud services, and retail services:

Apple iFamily Hardware Devices

- Wearable mobile post-PC hardware devices (prospective iGlasses and iWatch)

- Non-wearable mobile post-PC hardware devices (iPod, iPhone, iPad)

- Non-mobile post-PC hardware devices (Apple TV and prospective iTV)

- Non-wearable mobile non-post-PC hardware devices (MacBook Air, MacBook Pro)

- Non-mobile non-post-PC hardware devices (Mac mini, iMac, and Mac Pro)

Apple iFamily System and Application Software

- Post-PC system software (iOS)

- Post-PC application software (iTunes, iLife, and iWork for iOS)

- Non-post-PC system software (Mac OS X)

- Non-post-PC application software (iTunes, iLife, and iWork for Mac OS X)

Apple iFamily Cloud and Retail Services

- Post-PC cloud services (App Store)

- Non-post-PC cloud services (Mac App Store)

- Post-PC and non-post-PC cloud services (iTunes Store, iBooks Store, iCloud)

- Post-PC and non-post-PC retail services (Apple Stores around the globe)

- Post-PC and non-post-PC online retail services (apple.com)

For each of the strategic categories listed above, we highlight the corresponding post-PC strategic assets and non-post-PC strategic assets possessed

by Apple in parentheses. Having identified the strategic categories and strategic assets that constitute the Apple iFamily solution suite, we are now ready to begin the process of applying the

Cyclefund strategic investment framework to Apple.

Apple's Strategic Assets

The first step in applying the strategic investment framework is to identify the strategic assets of the firm or business unit under analysis. The strategic assets of a firm or business unit comprise strategic resources (such as, human capital, financial capital, physical assets, and intangible assets), strategic processes (internal, external, and collaborative design processes, development processes, manufacturing processes, sales and support processes, and partnership processes), and strategic solutions (seamlessly integrated combinations hardware, software, and services designed to meet the needs of users in consumer markets, business markets, education markets, and government markets).

With the concept of a strategic asset defined above, we can now quickly and clearly identify the strategic assets of Apple, as listed and organized below by strategic

resources, strategic processes, and strategic solutions:

Apple's Strategic Resources

- Apple employees and management team

- Apple balance sheet

- Apple headquarters and design centers

- Apple patent portfolio

- Apple brand

Apple's Strategic Processes

- Apple hardware design, development, and manufacturing processes

- Apple software design, development, manufacturing, and support processes

- Apple service design, development, deployment, and operations processes

- Apple solution marketing, sales, and support processes

- Apple strategic manufacturing, carrier, and retail partnership processes

Apple's Strategic Solutions

- Apple post-PC hardware devices

- Apple non-post-PC hardware devices

- Apple post-PC software

- Apple non-post PC software

- Apple online media and application services

- Apple offline and online retail stores

Moreover, by employing the formal definition of the iFamily solution suite concept presented previously, we can construct a definitive list of the specific individual

strategic solution assets of Apple, as organized by hardware devices, software, and service categories below:

Apple Post-PC Hardware Devices

- Apple iGlasses (prospective)

- Apple iWatch (prospective)

- Apple iPod

- Apple iPhone

- Apple iPad

- Apple TV

- Apple iTV (prospective)

Apple Non-Post-PC Hardware Devices

- Apple MacBook Air

- Apple MacBook Pro

- Apple Mac mini

- Apple iMac

- Apple Mac Pro

- Apple Mac Pro Server

Apple Post-PC Software

- Apple iOS

- Apple iTunes for iOS

- Apple iLife for iOS

- Apple iWork for iOS

Apple Non-Post-PC Software

- Apple Mac OS X

- Apple iTunes for Mac OS X (and Microsoft Windows)

- Apple iLife for Mac OS X

- Apple iWork for Mac OS X

- Apple Mac OS X Server

Apple Online Media and Application Services

- Apple App Store

- Apple Mac App Store

- Apple iTunes Store

- Apple iBooks Store

- Apple iCloud

Apple Offline and Online Retail Stores

- Apple Stores located around the globe

- Apple apple.com on the worldwide web

The definitive list of Apple's individual strategic solution assets presented above represents a unique and unmatched combination of hardware, software, and service

assets all designed from the very beginning to be combined synergistically and integrated seamlessly to provide a holistic and singular experience for users in consumer markets, business markets,

education markets, and government markets around the globe. Having taken the first step in applying the strategic investment framework to Apple, we are now ready to take the next step.

Apple's Strategic Offering for the Post-PC

Era

The second step in applying the strategic investment framework is to identify the strategic offering

of the firm or business unit under analysis. A strategic offering is defined as the set of strategic resources, strategic processes, and strategic solutions of a firm or business unit

that are visible to customers and utilized as a basis for competitive evaluation prior to making a final purchasing decision. That is, a strategic offering is the subset of strategic assets

that are visible to buyers when purchasing decisions. Therefore, while the set of strategic assets is an absolute notion, the set of elements in a strategic offering is a relative notion that depends

entirely on the perspective of the viewer, or buyer in this case.

For example, if we examine the set of strategic assets for Apple, as listed above, we see that the strategic resources of Apple and the strategic processes of Apple (other than the Apple brand and

the Apple solution marketing, sales, and support processes) are not entirely visible to most consumers, and therefore are not highly relevant when consumer buyers evaluate competitive offerings. On

the other hand, for business organizations, education organizations, and government organizations, who tend to conduct lengthy request for information (RFI) exercises, request for proposal (RFP)

procedures, solution demonstrations (demos), and proposal evaluation meetings across multiple vendors all actively engaged in heated competition, the strategic resources of Apple and the strategic

processes of Apple are examined in great and in some cases exhaustive detail. Thus, all three strategic asset classes, strategic resources, strategic processes, and strategic solutions, are highly

relevant when business, education, and government buyers evaluate competitive offerings.

From this discussion, we see clearly that Apple's strategic offering for consumers is approximately equivalent to its set of

strategic solution components when viewed from the perspective of consumer buyers, and Apple's strategic offering for enterprises is approximately equivalent to its full set of strategic

assets when viewed from the perspective of business, education, and government buyers. This conclusion represents a very significant and powerful insight, as it implies that consumers make their

final buying decisions based on strategic solution components of a firm, whereas business, education, and government organizations make their final buying decisions based on the full set of strategic

assets of a firm.

The King of the Post-PC Era

Up to this point, we have taken the first two steps in applying the strategic investment framework to Apple. In step one, we identified the

full set of strategic assets of Apple. Then, in step two, we identified Apple's strategic offering for consumers and Apple's strategic offering for enterprises. With these

two key steps completed, as well as the background on the PC application-suite model and the post-PC solution-suite model presented above, we can formally begin the more extensive process of seeking

an answer to the foremost question on everyone's mind in the investment community:

- "Who will be the true king of the post-PC era?"

To begin to address this question, if we first assume that the bring your own device (BYOD) to work movement continues to gain

ground as the post-PC era becomes more engrained in societies around the globe, then we can further assume that consumer buying decisions will indeed initially crown the next king of the post-PC era

and anoint this dominant vendor with disproportionate market share or disproportionate profits, or both, as was the case with the once-dominant Microsoft in the graphical PC era.

Should both of these assumptions hold, then the determination of who will be

king rests assuredly in the hands of the consumer in the near term. Since we have already established that consumers make their buying decisions by evaluating

strategic offerings across one or more competitors and that, unlike enterprises, the strategic offering for consumers is roughly equal to the set of strategic solution assets of a firm, we can

postulate that the future king of the post-PC era will be the singular firm that delivers on the iFamily solution-suite concept defined previously.

Note that our postulation does not formally state that Apple will be king of the post-PC era, but rather it states that the first firm, or

group of collaborative firms, to successfully deliver and realize the truly vast and unprecedented potential of the iFamily concept will be most likely to rise be king of the post-PC era, with Apple

and a small handful of other global-scale firms as leading candidates.

While it is quite possible that other candidates for the title of king of the post-PC era do exist, including Google, Samsung, Microsoft, and Amazon, these firms must not only possess the set of

strategic solution components equivalent to the Apple iFamily solution suite, but they also must possess the set of strategic resources and strategic processes that enable them to deliver and

continuously enhance their strategic offering to all customers, including initial king-making consumer customers, as well as king-sustaining business, education, and government customers, whose

opinions on which firm, or tightly knit set of firms, should remain king will be more important as the post-PC era matures and buying power becomes more balanced between consumer and non-consumer

buyers.

In the near term, however, it is Apple's game to lose, as long as no other firm, or tightly knit set of firms such as Google working closely with Samsung and other global strategic partners or more

remotely Samsung working closely with Microsoft and Google, usurp Apple's lead and take command of the nascent yet overwhelmingly strategic iFamily concept.

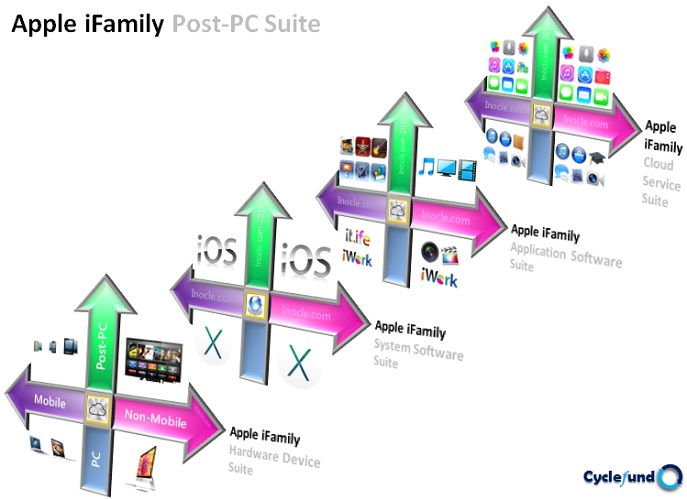

Visual Definition of the Apple iFamily Suite

Given the strategic importance of the iFamily solution suite concept in the context of consumer buying decisions, as well as the critical role of the consumer in determining the true king of the

post-PC era, we now focus our attention on strategically positioning the core assets of the Apple iFamily suite utilizing the visual framework entitled the Multidimensional Strategic Positioning

Framework for the Post-PC Era presented in the iGlass - Internet Glasses section of the inocles.com website.

We utilize the strategic positioning framework to visually organize the following groups of strategic assets of the iFamily suite:

- iFamily Suite Hardware Device Assets

- iFamily Suite System Software Assets

- iFamily Suite Application Software Assets

- iFamily Suite Cloud Service Assets

Once we have positioned each of the strategic assets from each of the strategic asset groups within a specific layer, or slice, of the

multidimensional strategic positioning framework, we will conclude by combining all of the slices together to present for the first time a grand unified visual definition of the Apple iFamily

Suite.

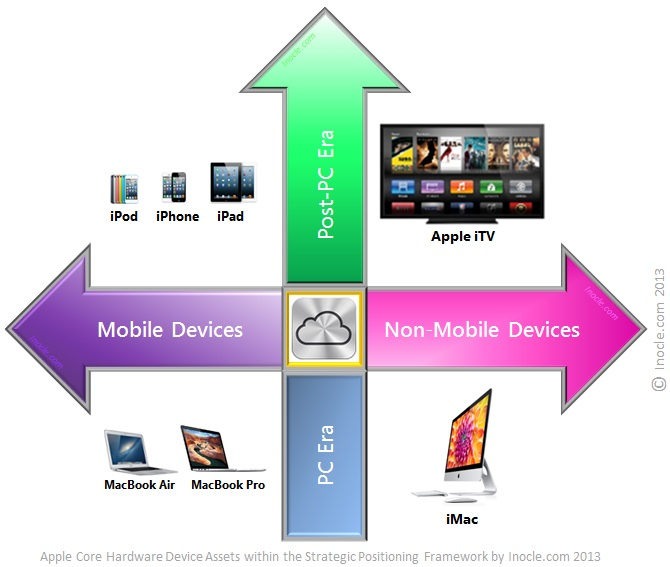

Apple iFamily Suite: Hardware Device Assets

The diagram below strategically positions and visually organizes the core hardware device assets of the Apple iFamily solution suite concept.

We refer to this diagram as the Core Hardware Device Assets of the Apple iFamily Suite. The upper left-hand quadrant represents non-wearable mobile post-PC

hardware assets, including Apple iPod, iPhone, and iPad, as well as

wearable mobile post-PC hardware assets, including prospective Apple iWatch and iGlasses. The lower left-hand quadrant depicts mobile non-post-PC hardware assets, including Apple MacBook

Air and MacBook Pro. The lower right-hand quadrant represents non-mobile non-post-PC hardware assets, including Apple iMac, as well as Apple Mac mini (not shown because the product sits outside the

core) and Apple Mac Pro (not shown). The upper right-hand quadrant represents non-mobile post-PC hardware assets, including the prospective Apple iTV, as well as Apple TV (not

shown). And the center of the diagram represents datacenter post-PC and

non-post-PC hardware assets, including iCloud infrastructure, as well as Apple Mac Pro Server (not shown).

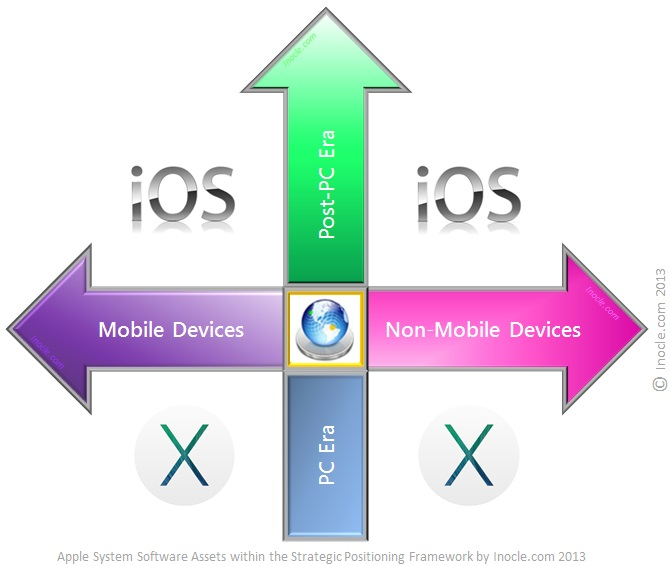

Apple iFamily Suite: System Software Assets

The diagram below strategically positions and visually organizes the core system software assets of the Apple iFamily solution suite concept.

We refer to this diagram as the System Software Assets of the Apple iFamily Suite. The upper left-hand quadrant depicts mobile post-PC system software

assets, including Apple iOS. The lower left-hand quadrant depicts mobile non-post-PC system software assets, including Apple OS X. The lower right-hand quadrant depicts non-mobile non-post-PC system

software assets, including Apple OS X. The upper right-hand quadrant depicts non-mobile post-PC system software assets, including iOS. And the center of the diagram depicts datacenter post-PC and

non-post-PC system software assets, including OS X Server.

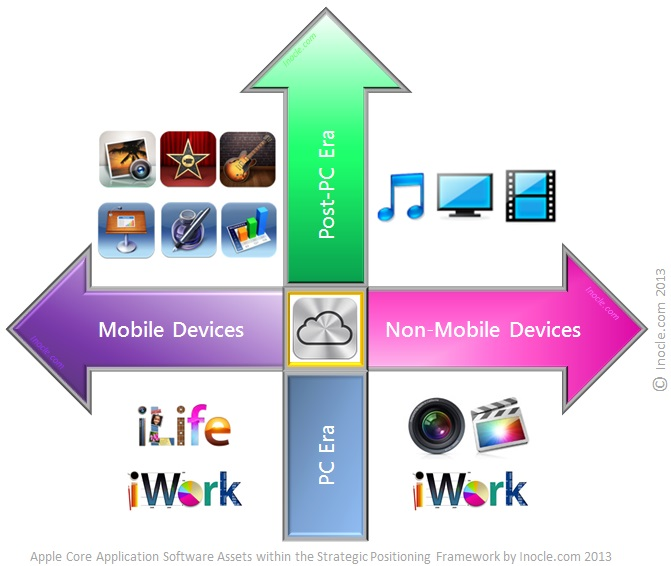

Apple iFamily Suite: Application Software Assets

The diagram below strategically positions and visually organizes the core application software assets of the Apple iFamily solution suite

concept.

We refer to this diagram as the Core Application Software Assets of the Apple iFamily Suite. The upper

left-hand quadrant depicts mobile post-PC application software assets, including Apple iPhoto, iMovie, GarageBand, Keynote, Pages, and Numbers applications, or apps, for iOS. The lower left-hand

quadrant depicts mobile non-post-PC application software assets, including Apple iLife and iWork application suites for OS X. The lower right-hand quadrant depicts non-mobile non-post-PC application

software assets, including Apple Aperture, Final Cut Pro, and iWork applications and application suites for OS X. The upper right-hand quadrant depicts non-mobile post-PC application software assets,

including Apple music, video, and movie media player applications for Apple TV. And the center of the diagram depicts datacenter post-PC application software assets, including Apple

iCloud.

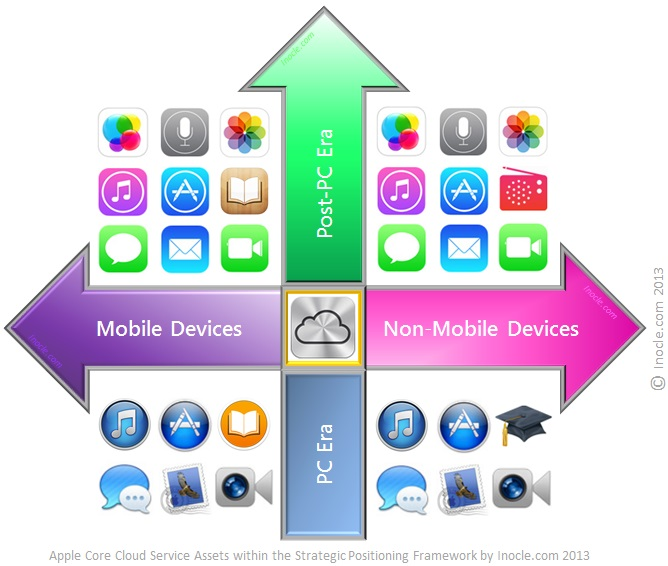

Apple iFamily Suite: Cloud Service Assets

The diagram below strategically positions and visually organizes the core cloud service assets of the Apple iFamily solution suite

concept.

We refer to this diagram as the Core Cloud Service Assets of the

Apple iFamily Suite. The upper left-hand quadrant represents mobile post-PC cloud service assets, including Apple Game Center, Siri, Photo Stream, iTunes Store, App Store, iBooks Store,

iMessage, Mail, and FaceTime cloud services, as well as Maps (not shown), Newsstand (not shown), Passbook (not shown), and iTunes Radio (not shown in this quadrant). The lower left-hand quadrant

represents mobile non-post-PC cloud service assets, including Apple iTunes cloud service for Mac and PC computers, Mac App Store, iBooks, Messages, Mail, and FaceTime cloud services for Mac

computers, as well as Apple iTunes U (not shown in this quadrant) for Mac and PC computers. The lower right-hand quadrant represents non-mobile non-post-PC cloud service assets, which are essentially

identical to Apple mobile non-post-PC cloud service assets. The upper right-hand quadrant represents non-mobile post-PC cloud service assets, which are essentially identical to Apple mobile post-PC

cloud service assets. And the center of the diagram depicts datacenter post-PC cloud service assets, including Apple

iCloud.

Apple iFamily Suite: Grand Unified Visual

Definition

By combining the four individual slices of the multidimensional strategic

positioning framework into a single view, we arrive at a very powerful visual definition of the Apple iFamily solution suite concept, as illustrated for the first time in the diagram

below.

The diagram above is called the Grand Unified Visual Definition of the Apple iFamily Post-PC Suite Concept. It is structured in three dimensions and contains a total of sixteen quadrants organized into four layers of four quadrants each, where each layer represents a unique slice of the multidimensional strategic positioning framework. As illustrated in the diagram, each layer corresponds to one of the following four distinct sub-suites within the overall iFamily post-PC suite:

- The iFamily Hardware Device Suite

- The iFamily System Software Suite

- The iFamily Application Software Suite

- The iFamily Cloud Service Suite

Each sub-suite is based on a

core set of strategic assets described previously that make it very difficult for competitors not possessing a critical mass of these core assets to replicate, duplicate, or imitate not only any

individual sub-suite but also the complete iFamily post-PC suite itself.

We have specifically employed the term post-PC suite because we strongly believe a) the future of computing will be determined by the unification of the modern post-PC era

with the traditional PC era and b) global population cycles and mobile technology cycles strongly favor accelerating post-PC growth versus decelerating or declining PC growth. More

briefly and cogently stated, we strongly believe that the modern post-PC era will engulf the traditional PC era.

Who Will Dominate the Post-PC Suite Category and be Crowned Post-PC

King?

We believe that there are only

four global firms in existence today with the set of strategic assets or the resources to develop the set of strategic assets required to build and deliver a unified iFamily post-PC solution suite to

consumers and businesses on a global scale. The four post-PC king candidate firms are Apple, Google, Samsung, and Microsoft.

Based on our presentation and analysis, it is clear that Apple possesses the strategic assets to strongly assert itself as the number one player in the new post-PC suite category, should it choose to

do so. However, as we shall see, the

Google/Samsung

partnership is not far behind

and the dark-horse combination of Microsoft and Nokia cannot be overlooked, especially with Microsoft's recent acquisition of the Nokia handset business.

Of these four candidate firms, we believe that one or more will emerge with the dominant post-PC solution suite and, as a result, will take the leadership position as king of the post-PC era. More

formally, we can now definitively address and predictively answer the fundamental question posed earlier: Who will be the true king of the post-PC

era?

- The king of the post-PC era shall be the single firm or group of firms providing the very best post-PC suite comprising a unified collection of post-PC devices, system software, application software, and cloud services to consumer and business customers on a global scale.

Should this post-PC prediction

hold, the ramifications for all non-king competitors within the modern post-PC space and the traditional PC space would be considerable, leading private, institutional, and retail investors

worldwide to adjust their equity exposure to highly-probable post-PC kings markedly upward and to highly-improbable post-PC kings dramatically downward. Specifically, we expect global investors to

react to the clear emergence of a post-PC king or kings by significantly increasing their allocation to long investment positions in post-PC king companies over time and by dramatically decreasing

their allocation to non-king companies, or by shorting non-king companies outright.

Given our strong conviction in our post-PC prediction and our clear expectations for global equity investor reactions (long post-PC kings, short non-kings), our challenge as post-PC investors now

becomes the early identification of dominant post-PC suite providers and high-likelihood post-PC

kings.